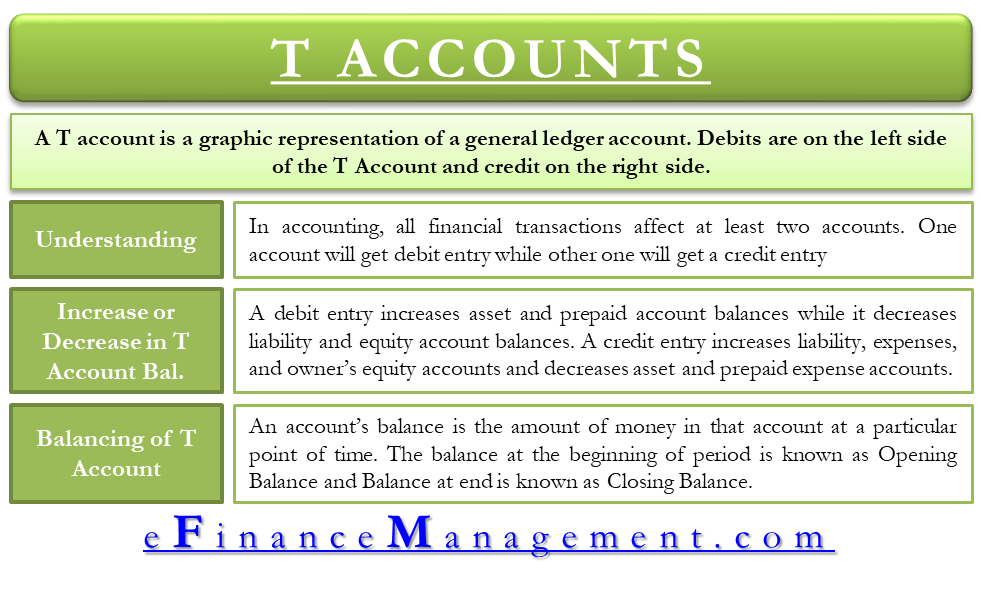

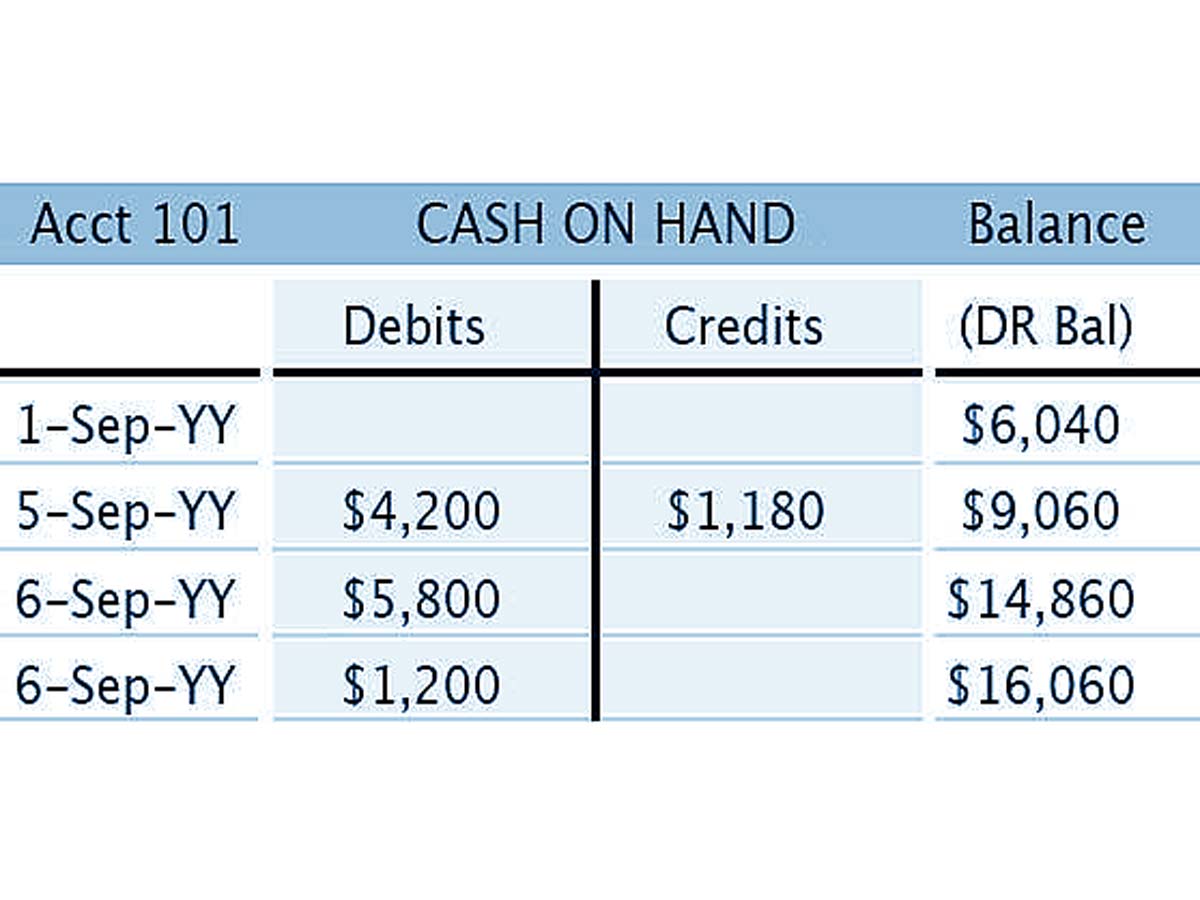

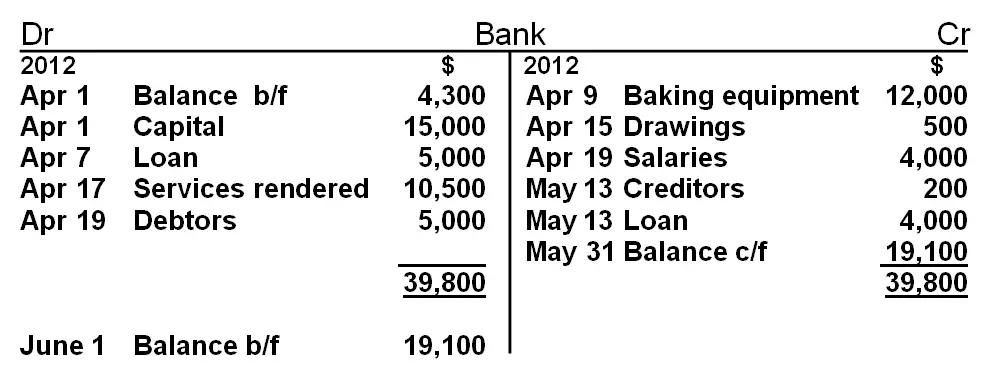

Aksara sold its products to two customers on credit. Then insert the following illustration into the journal entry: We take the CoA assumption that we’ve made before for PT. So cash balance rates increase in debt and decrease in credit. Cash accounts are one part of an asset account that has normal properties or balance in the debt position. Here’s a simple example of a T-Account for Cash accounts:Īs previously noted, each account has a basic characteristic regarding the double-entry namely debit and credit records. The T-account serves to help the reader of the accounting journal in view of the transaction summaries and the final balance score at a period in one account. For more details, there is an account summary in the journal that shows all transaction activity for a period that affects the balance value of each account. Here’s a Chart of Account example: Example Chart of AccountĮach account has a balance value that can go up or down when the transaction occurs. Then for accounts such as the building, vehicles, and the accumulated depreciation that is part of fixed assets are generally given the initial number “2”, and so on. The number on the accounts is sequential according to the type of account itself.įor example, since cash accounts, debts, and inventories are part of current assets, each account generally has an initial number of “1”. In the ledger, each active account is neatly organize of the CoA list. Then you should know the normal balance and have a CoA list. In making examples of accounting ledgers, and before recording a general journal. The arrangement of this book is meant to obtain information relating to the company’s debts, which means it contains information on which suppliers are in debt and how much. The creditor ledger is almost similar to the debtor’s ledger, but it provides information from just one journal, the journal of purchase. So the compilation was to obtain information about company debt. Unlike the usual, the debtor ledger contained information only about which customers have debts in their business and how much of it is from one journal, namely the sales journal. While the receivable book records companies that make transactions on credit. So you can get a list of suppliers who give credit loans to the company and its value. The debt books contain detailed records of the suppliers. Usually, the company will arrange this book into two categories – payable subsidiary ledger or receivable subsidiary ledger In this ledger, you can get a more identical transaction record of a special transaction. Next, we have the subsidiary ledger which extends the length of the general ledger. In it, you will obtain transaction-related data that include cash, receivables, inventory, debt, and expenses. The transaction record is a stand-alone column in a period. The following are four categories in a journal that you need to know and which is the company’s need: General ledgers Can be used as material or information in the compilation of financial statements.To monitor and process transaction easily, you can use POS system. As a basis for classifying existing transactions and entries in the journal.Into a device that classifies financial data and knows the number or state of the account in the actual account, whether there is a difference or not.As a tool to summarize transaction data in public journals has been record.Ledgers have several functions used during the accounting process, including:

How to do a ledger t account how to#

Examples of Ledger and How to Make Them.

0 kommentar(er)

0 kommentar(er)